AI-Powered Institutional Asset Management: Building Agentic RWA Strategies on Sei

Quantitative trading is moving from black boxes to transparent code. This guide explains how Sei's Model Context Protocol (MCP) empowers AI agents to autonomously manage tokenized Real-World Assets (RWAs) like U.S. Treasuries with 400ms finality and institutional-grade verification.

For years, quantitative trading strategies remained locked inside complex, black-box systems. Now with tokenized treasuries, stablecoins, and other Real-World Assets (RWAs) established onchain, these strategies are being transformed into transparent, programmable code. In parallel, the rapid advancement of AI agents is reshaping data analysis and decision-making.

This transformation creates a powerful opportunity: the ability to leverage advanced AI agents to autonomously and dynamically manage complex portfolios with unprecedented precision and speed. Building AI agents that can read onchain data, rebalance complex portfolios, and prove every step of their logic on a blockchain requires a network built for institutional-grade performance.

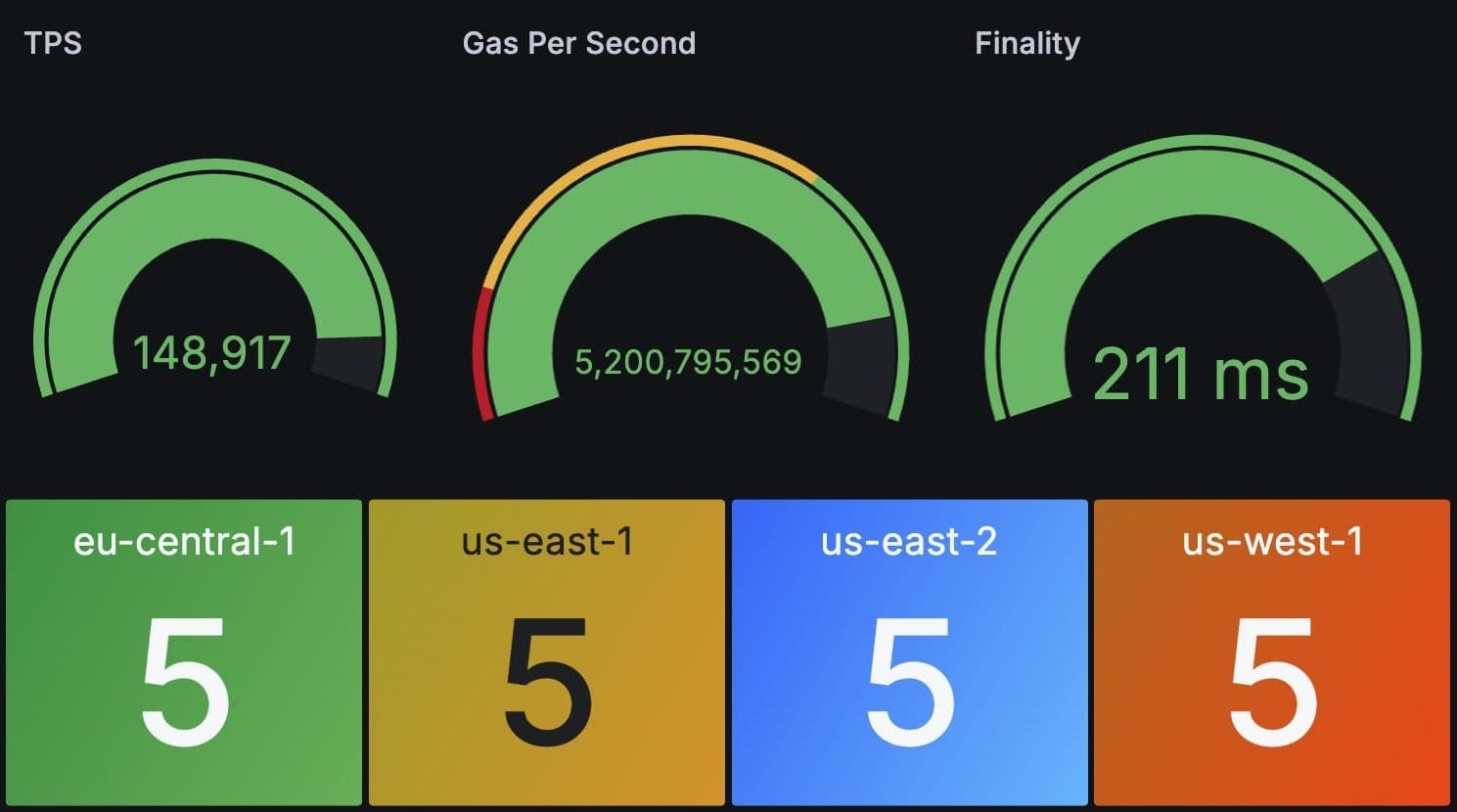

Sei delivers on this need. With its 400ms finality and the integrated Model Context Protocol (MCP), Sei directly connects AI agents to onchain data with execution at machine speed. Developers no longer need to piece together disparate APIs or rely on opaque infrastructure. For builders, Sei provides the toolkit for creating the future of AI-powered institutional asset management.

The Rise of Tokenized Real-World Assets

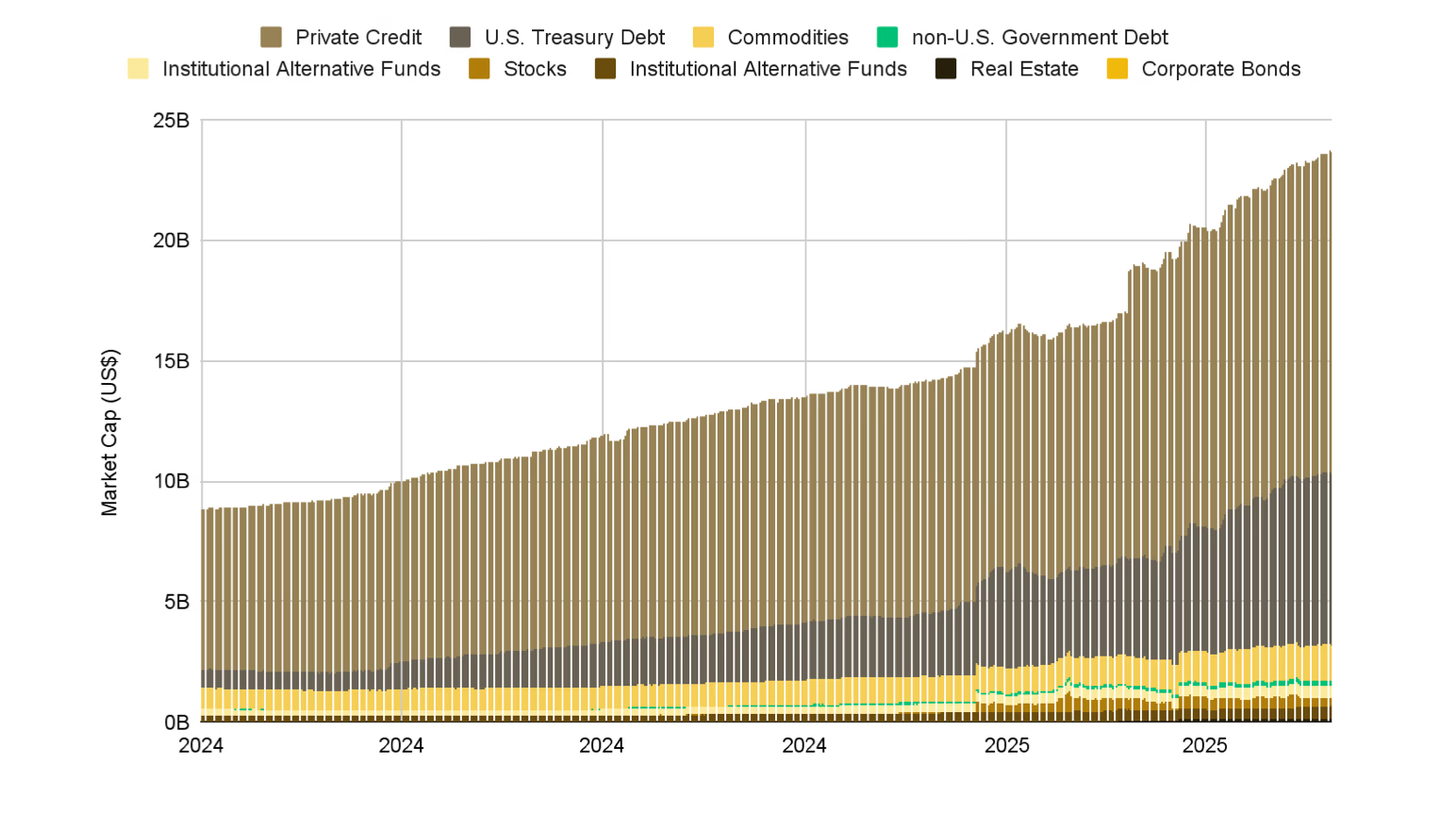

Institutional capital is increasingly seeking predictable, onchain yield. As a result, we’ve seen the total RWA market grow to over $35 billion as of November 2025. Tokenized U.S. Treasuries, the leading RWA use-case, have surged to over $8 billion in total market cap in 2025.

Tokenization transforms large, traditionally illiquid instruments into fractional, programmable units. This grants them composability, allowing developers to combine assets across different protocols. These assets also trade 24/7, making them ideal for automated strategies. Moreover, compliant participants can build and ship strategies without broker bottlenecks.

Managing these strategies at an institutional scale introduces significant challenges that require highly performant blockchains, like Sei:

- Performance Bottlenecks: Most blockchains lack the speed required for real-time portfolio rebalancing, creating execution risk.

- Verification Gaps: Institutions require verifiable audit trails and deterministic execution, which is difficult to guarantee with AI inputs.

- Liquidity Fragmentation: Cross-chain orchestration adds operational and security overhead, fragmenting liquidity and complicating strategies.

The growing adoption of RWAs on fast, high-performance blockchains is clearly demonstrated by the tokenized assets currently live on Sei. The network now hosts Circle's native USDC for instant settlement alongside live institutional investment vehicles accessed via leading tokenization platforms. This includes Apollo’s Diversified Credit Fund (ACRED) via Securitize, as well as Hamilton Lane’s SCOPE fund and offerings from BlackRock and Brevan Howard via KAIO. With these regulated, institutional-grade assets live on Sei, the infrastructure is ready; the next step is layering on the intelligence to manage them.

How Sei Enables Agentic RWA Strategies

Executing agentic RWA strategies at scale empowers automated agents to perform several critical functions:

- Detect Patterns: Analyze macroeconomic data and onchain signals to assess spread changes and liquidity stress in near-real time.

- Automate Rebalancing: Autonomously shift allocations between tokenized RWAs and stablecoins based on live market data.

- Monitor Risk: Track interest rate movements, fund flows, and venue-level depth to activate protective guardrails before slippage or de-pegs occur.

For this to work at institutional speed, AI agent decisions must be fast, verifiable, and executed through a standardized framework. Sei's Model Context Protocol (MCP) integration provides this foundation.

What is the Model Context Protocol (MCP)?

The Model Context Protocol (MCP) is an open standard developed by Anthropic that allows AI systems to safely connect to external data, tools, and services. It provides a secure and uniform way for AI agents to read blockchain state, execute transactions, and prove their actions. With MCP on Sei, agents can:

- Read token balances, contract variables, and transaction history.

- Interact with smart contracts.

- Execute token transfers.

- Monitor onchain activities like trades in real-time.

Sei’s Technical Advantages for AI-Powered Asset Management

Real-time institutional strategies require more than just blockchain access—they need speed, verifiability, and native asset support. Sei enables MCP to be leveraged for high-performance applications of RWA strategies through three core advantages:

- Standardized, High-Speed Access: On Sei, AI agents use standard MCP interfaces instead of custom, brittle blockchain APIs. This allows them to query network state, manage portfolios, and execute transactions through simple, repeatable calls at the speed of the network.

- Verifiable, High-Throughput Actions: Sei’s parallelized EVM and the high throughput of Sei V2 enables large-scale data workloads and multi-agent systems where different agents can verify each other’s work onchain.

- Seamless Multi-Protocol Operations: MCP allows agents to interact with multiple DeFi protocols through a single, unified interface. Combined with Sei's parallel execution, agents can coordinate complex, multi-protocol strategies, like atomic cross-protocol trades, efficiently and without bottlenecks.

Looking ahead, the Sei Giga upgrade targets a throughput of 5 gigagas per second, making it even easier to publish and verify massive amounts of agent activity data. This level of performance unlocks the potential for transparent, multi-agent systems where trust is built on a foundation of verifiable onchain history.

Build Agentic RWA Strategies with Sei’s MCP Kit Today

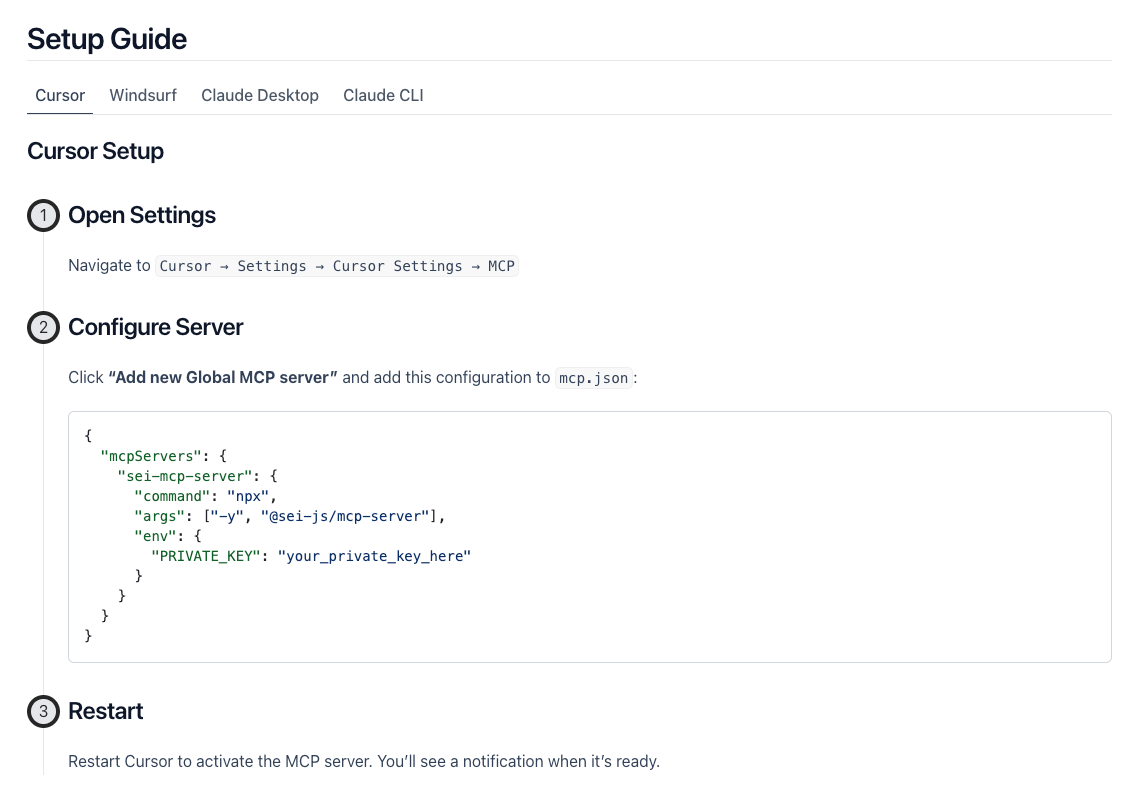

If you’re ready to get started, you can set up Sei’s MCP kit in a few easy steps. Ensure you have a standard installation of Cursor, Windsurf, or Claude, and then you can deploy it from the respective environment's settings. Go to the Sei MCP kit docs and start deploying MCP across each environment today.

Leading the Transformation with Sei

As the market for tokenized real-world assets scales, the competitive edge will go to those who can effectively automate, verify, and move at speed. Sei’s implementation of the Model Context Protocol provides developers with the essential tools to build AI agents that read data, rebalance in real-time, and verify every action. This is where AI-native strategies begin to shape the future of capital markets onchain.

Frequently Asked Questions (FAQ)

What is Agentic AI in crypto?

Agentic AI refers to autonomous AI agents that can execute complex tasks on a blockchain without human intervention. Instead of just analyzing data, they can manage portfolios, rebalance assets, and execute trades in real-time.

What is the Model Context Protocol (MCP)?

The Model Context Protocol (MCP) is an open standard that lets AI systems safely connect to external data and tools. On Sei, it allows AI agents to read blockchain data and execute transactions securely.

Why are Real-World Assets (RWAs) moving onchain?

Tokenizing assets like U.S. Treasuries makes them programmable, liquid, and accessible 24/7. It removes traditional bottlenecks like settlement delays and allows for automated management by AI agents.

Why is Sei good for institutional AI strategies?

Sei offers 400ms finality and high throughput, which are essential for real-time execution. Its integration with MCP provides a standardized way for institutions to build verifiable, compliant AI trading strategies.

Start building on Sei today. Explore the Sei ecosystem.

Disclaimer:

This post is provided for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities, digital assets, or investment products. Any forward-looking statements, projections, or descriptions of anticipated activities are subject to risks and uncertainties and may not reflect actual future outcomes. Sei Development Foundation is not offering or promoting any investment in SEI tokens or digital assets, and any references to token-related activity are subject to applicable U.S. securities laws and regulations. All activities described herein are contingent upon ongoing legal review, regulatory compliance, and appropriate corporate governance. This post should not be relied upon as legal, tax, or investment advice.