What Is Slippage and How Does It Work in Crypto?

Learn what slippage is in crypto trading, how CEX vs DEX mechanics work, and strategies to minimize the $2.7B cost of immediacy in 2025.

Key Takeaways:

- Core Definition: Slippage is the "cost of immediacy," representing the difference between your expected price and the actual execution price.

- Surging Costs: Aggregate slippage costs reached $2.7 billion in 2024 (a 34% increase), affecting both retail and whale traders.

- CEX Dynamics: On centralized exchanges, slippage happens when market orders "walk through" the order book to find available liquidity.

- DEX Mechanics: Decentralized exchanges use AMM formulas (like $x \times y = k$) where larger trades shift the token ratio and price automatically.

- Strategic Mitigation: Traders can minimize impact by using Limit Orders, TWAP algorithms, or trading during high-liquidity windows.

- Hidden Risks: Advanced threats include MEV bots front-running transactions and additional slippage during cross-chain bridge transfers.

Table of Contents

- The Current State of Slippage (2025)

- Defining Slippage

- Mechanics of Execution

- Types of Slippage

- Real-World Case Studies

- Strategies to Minimize Costs

- Advanced Risks & Considerations

- Best Practices for 2025

- Frequently Asked Questions

The $2.7 Billion Problem Getting Worse in 2025

Understanding what is slippage has become more critical than ever for crypto traders as market dynamics continue evolving. As of 2025, slippage costs across decentralized and centralized exchanges have reached unprecedented levels, with recent data from Kaiko Research showing that aggregate slippage costs exceeded $2.7 billion in 2024, representing a 34% increase from the previous year. This surge isn't just affecting whale traders. Retail participants are feeling the pinch as market volatility and fragmented liquidity create perfect conditions for adverse price execution.

The landscape has shifted dramatically since the early days of crypto trading. With over 200 active decentralized exchanges and countless automated market makers (AMMs) competing for volume, traders face a complex web of liquidity pools, each with its own slippage characteristics. Meanwhile, centralized exchanges have introduced sophisticated fee structures and liquidity incentives that fundamentally alter how slippage impacts your bottom line.

Understanding Slippage: The Price You Pay for Immediacy

Slippage represents the difference between the price you expect to pay for a cryptocurrency trade and the actual price at which your order executes. This phenomenon occurs because crypto markets are dynamic environments where prices fluctuate constantly, and your trade must find available liquidity at prevailing market rates.

Think of slippage as the cost of immediacy. When you place a market order to buy 10 ETH at $3,000 per token, you're essentially saying "I want this trade executed now, regardless of minor price variations." If the order executes at an average price of $3,015 per ETH, you've experienced 0.5% negative slippage. Or $150 in additional costs.

Why Crypto Slippage Differs from Traditional Markets

Unlike traditional stock markets with designated market makers and regulatory oversight, crypto markets operate with fragmented liquidity across multiple venues. A single token might trade on dozens of exchanges simultaneously, each with different order books and liquidity depths. This fragmentation means that slippage can vary dramatically depending on where and how you execute your trades.

Additionally, crypto markets never close. The 24/7 trading environment means liquidity conditions can shift rapidly during off-peak hours, particularly affecting Asian and European trading sessions when institutional participation traditionally decreases.

The Mechanics Behind Slippage: Order Books vs. AMMs

Slippage manifests differently depending on the trading mechanism your chosen platform employs. Understanding these differences is crucial for optimizing your execution strategy.

Centralized Exchange Order Book Dynamics

On centralized exchanges like Binance or Coinbase, slippage occurs when your market order "walks through" the order book. If you're buying a large amount of Bitcoin, your order will first match with the best available sell orders. Once those are exhausted, it moves to the next price level, and so on, until your entire order is filled.

The depth of the order book determines how much slippage you'll experience. During high-volume periods, order books typically have more liquidity at each price level, reducing slippage. Conversely, during quiet market periods or for less popular trading pairs, even moderate-sized orders can cause significant price impact.

Automated Market Maker Mathematics

Decentralized exchanges using AMM models like Uniswap operate on an entirely different principle. Instead of matching buyers and sellers directly, AMMs use mathematical formulas to determine prices based on the ratio of tokens in liquidity pools.

The most common formula, used by Uniswap v2 and v3, is the constant product formula: x × y = k, where x and y represent the quantities of two tokens in a pool, and k remains constant. When you trade, you're essentially shifting this ratio, which automatically adjusts the price. Larger trades create bigger ratio changes, resulting in more slippage.

Positive vs. Negative Slippage: Understanding the Impact

Slippage isn't always detrimental to traders. Understanding both positive and negative slippage helps you make more informed decisions about order types and execution strategies.

When Slippage Works in Your Favor

Positive slippage occurs when market conditions improve between order placement and execution. For instance, if you place a market buy order for Solana at $95, but the order executes at an average price of $94.50 due to a sudden sell-off, you've benefited from positive slippage.

This scenario is more common during volatile market periods when prices can swing rapidly in either direction. High-frequency trading algorithms and market makers often capitalize on these micro-movements to generate profits.

The Hidden Cost of Negative Slippage

Negative slippage represents the more familiar scenario where execution prices are worse than expected. This cost compounds over time, particularly for active traders. Consider a trader making 50 transactions per month with an average negative slippage of 0.3%. Over a year, this seemingly small percentage can reduce returns by 1.8%, a significant drag on performance.

According to Binance Research data from late 2024, retail traders on average experience 0.4% more slippage than institutional traders due to suboptimal execution timing and order sizing strategies.

Real-World Slippage Examples from 2025's Leading Platforms

Let's examine specific slippage scenarios from major trading platforms to illustrate how these concepts apply in practice.

Binance Example: Large Market Order Execution

Consider a trader attempting to purchase $100,000 worth of Cardano (ADA) using a market order on Binance during moderate trading volume. Here's how the execution might unfold:

- Order Placement: Market buy order for $100,000 ADA at displayed price of $0.485

- Order Book Interaction: First 50,000 ADA filled at $0.485, next 30,000 ADA at $0.487, remaining 20,000 ADA at $0.489

- Final Execution: Average fill price of $0.4868, representing 0.37% negative slippage

- Cost Impact: Additional cost of $370 compared to the expected price

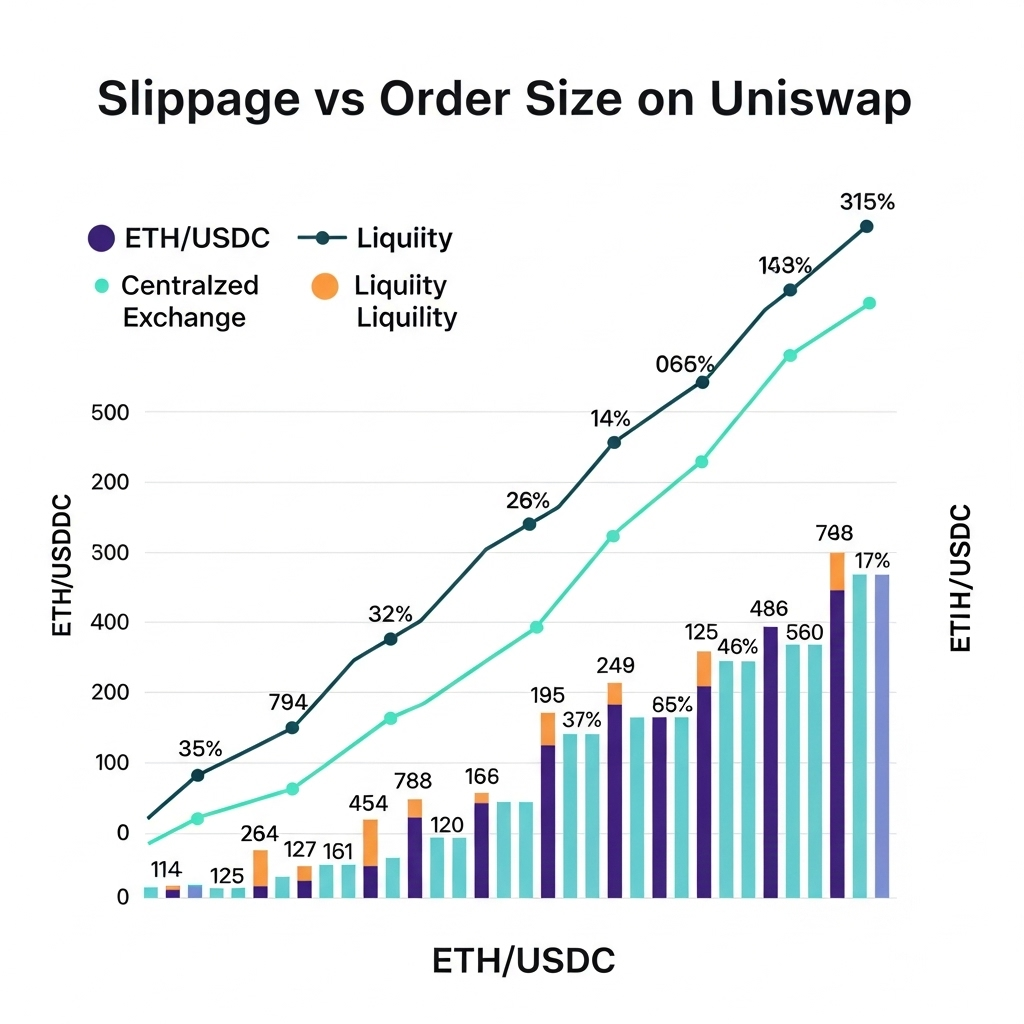

Uniswap v4 Example: AMM Price Impact

Now consider a similar trade executed on Uniswap v4's ETH/USDC pool with $50 million in total value locked (TVL):

- Initial Setup: Attempting to swap $100,000 USDC for ETH at displayed rate of 1 ETH = $3,000

- AMM Calculation: Large trade shifts pool ratio, causing price to increase during execution

- Price Impact: Average execution price of $3,018 per ETH due to the constant product formula

- Final Result: 0.6% slippage, receiving 33.11 ETH instead of the expected 33.33 ETH

Proven Strategies to Minimize Slippage

Successful crypto traders employ multiple tactics to reduce slippage costs and improve execution quality. These strategies range from basic order management to sophisticated algorithmic approaches.

Slippage Tolerance Configuration

Most modern trading platforms allow you to set maximum acceptable slippage levels. For major cryptocurrency pairs with high liquidity, setting tolerance between 0.5% and 1% typically provides good execution while preventing excessive costs. Smaller altcoins may require higher tolerances of 2-5% due to limited liquidity.

Time-Weighted Average Price (TWAP) Strategies

TWAP algorithms break large orders into smaller chunks executed over time, reducing market impact. Instead of placing a single $500,000 Bitcoin purchase, a TWAP strategy might execute 50 smaller orders of $10,000 each over several hours, smoothing out price impact and reducing overall slippage.

Utilizing Limit Orders

While market orders guarantee execution, limit orders provide price certainty at the cost of execution certainty. By setting limit orders at or near current market prices, you can often achieve better execution than market orders, especially during volatile periods.

Request for Quote (RFQ) Systems

Advanced traders increasingly use RFQ systems, particularly for large trades. These systems allow you to request quotes from multiple liquidity providers simultaneously, ensuring competitive pricing and reduced slippage for substantial transactions.

Trading During High-Liquidity Windows

Timing your trades during peak liquidity hours can significantly reduce slippage. For most major cryptocurrencies, the highest liquidity occurs during the overlap of European and North American trading sessions (roughly 12:00-16:00 UTC). During these periods, tighter spreads and deeper order books minimize price impact.

Advanced Slippage Risks and Considerations

Beyond basic slippage mechanics, sophisticated traders must navigate additional complexities that can amplify execution costs and create unexpected risks.

Maximal Extractable Value (MEV) Impact

MEV represents a hidden form of slippage that particularly affects DeFi traders. When you submit a transaction to the mempool, sophisticated bots can observe your intended trade and potentially front-run it, extracting value and increasing your effective slippage. This phenomenon has become increasingly prevalent as MEV extraction techniques grow more sophisticated.

Network Congestion and Gas Spikes

During periods of high network activity, transaction confirmation times can extend significantly. This delay creates additional opportunities for prices to move against your position, effectively increasing slippage. Moreover, the need to pay higher gas fees during congestion can make the total cost of trading prohibitive for smaller transactions.

Cross-Chain Bridge Slippage

As multi-chain trading becomes more common, bridge-related slippage adds another layer of complexity. Moving assets between blockchains often involves multiple transactions and various liquidity pools, each introducing potential slippage. Traders must account for these cumulative costs when planning cross-chain strategies.

Best Practices for Slippage Management in 2025

Implementing a comprehensive slippage management strategy requires combining multiple approaches tailored to your trading style and risk tolerance.

Start by analyzing your historical trades to understand your typical slippage costs. Most exchanges provide detailed execution reports that break down price impact and fees. Use this data to identify patterns and optimize your approach.

Consider using DEX aggregators like 1inch or Matcha, which automatically route your trades across multiple liquidity sources to minimize slippage. These platforms often achieve better execution than trading on individual DEXs, especially for larger orders.

For institutional-size trades, explore over-the-counter (OTC) desks that can provide fixed pricing for large transactions, eliminating slippage entirely. Many major exchanges now offer OTC services with competitive rates for trades exceeding $100,000.

Finally, stay informed about market microstructure developments. As blockchain technology evolves, new solutions for reducing slippage continue to emerge. Platforms like Sei Network, with their 400-millisecond finality, are pushing the boundaries of execution speed and reducing the time window for adverse price movements.

The crypto trading landscape continues evolving rapidly, with new tools and strategies emerging regularly to help traders optimize their execution. By staying informed about the latest developments in slippage management and continuously refining your approach, you can significantly improve your trading performance and preserve more of your profits. Our weekly newsletter delivers actionable insights on advanced trading strategies, including deep dives into execution optimization techniques that can save you thousands in trading costs annually.

Frequently Asked Questions (FAQ)

What is a good slippage tolerance for most crypto trades?

For most crypto trades, a slippage tolerance of 0.5-1% works well for major pairs like BTC/USDT or ETH/USDC. For smaller altcoins or DeFi tokens, 1-3% may be necessary due to lower liquidity. High-frequency traders often use 0.1-0.3% for optimal execution.

Does slippage affect limit orders on centralized exchanges?

No, properly executed limit orders on centralized exchanges should not experience slippage. Limit orders only execute at your specified price or better. However, partial fills may occur if there's insufficient liquidity at your target price.

How do I calculate my actual slippage after a trade?

Calculate slippage using this formula: ((Executed Price - Expected Price) / Expected Price) × 100. For example, if you expected to buy at $100 but executed at $102, your slippage is 2%. Most modern trading platforms display this automatically in your trade history.

Why is slippage higher on decentralized exchanges?

DEXs typically have lower liquidity than centralized exchanges, and their automated market maker (AMM) models create price impact for every trade. Additionally, network congestion can delay transaction execution, allowing prices to move unfavorably during confirmation periods.

Learn more about Sei at: https://www.sei.io/

Disclaimer:

This post is provided for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities, digital assets, or investment products. Any forward-looking statements, projections, or descriptions of anticipated activities are subject to risks and uncertainties and may not reflect actual future outcomes. Sei Development Foundation is not offering or promoting any investment in SEI tokens or digital assets, and any references to token-related activity are subject to applicable U.S. securities laws and regulations. All activities described herein are contingent upon ongoing legal review, regulatory compliance, and appropriate corporate governance. This post should not be relied upon as legal, tax, or investment advice.