The Sei Litepaper

Sei: the Layer 1 for Trading

Sei has one core thesis: the fundamental use case for blockchains is the ability to exchange digital assets. Thus, the problem of how to scale exchanges is instrumental to unlocking the next stage of growth for Web3 adoption. Sei is an open source, general purpose Layer 1 blockchain built for trading, optimized at every level of the stack to offer the best infrastructure for the exchange of digital assets.

The exchange of digital assets is the most fundamental use case of blockchains

Trading is not limited to the conventional understanding of candle charts, technical analysis, and derivatives. It encompasses a wide range of assets and activities, including trading tokens, NFTs, real-world assets, metaverse assets, risk, social-likeness, and more.

Notably, most successful Web3 apps are functionally exchanges, regardless of whether they market themselves as such. Examples of obvious exchanges include Uniswap, OpenSea, and Sushi. However, not all exchanges are as clear-cut. Axie Infinity and StepN are both games, but the exchange of the in-game assets is crucial to the user experience, so both are functionally exchanges as well. Hence why both gaming projects built their own NFT marketplace and DEX respectively.

The success of the most prominent Web3 apps is rooted in asset exchange. If applications are not directly exchanges, they typically drive most of their traffic and value from the exchange of assets. For example, Bitcoin's value comes from its ability to be exchanged. MetaMask users ultimately use an exchange like Uniswap or OpenSea for trading assets. It is the swap function that drives their use of the wallet. Similarly, people use Aave to get liquidity to buy something. Through this lens, trading is the most fundamental use case of blockchains, and its definition goes beyond what many people expect.

Why now? Exchanges are poised to grow exponentially

As Web3 continues to grow, the role of exchanges will only increase in importance. The proliferation of digital assets drives a greater need to exchange these assets, particularly since digital assets have a price marked 24/7. Trading will become an integral part of the industry. Furthermore, the higher regulatory pressure on centralized exchanges (CEXs) is likely to drive even more volume and activity on-chain. This will require DEXs to scale and adapt to a huge wave of adoption. Exchanging digital assets will not only remain relevant in Web3 but will grow exponentially alongside the industry.

The problem

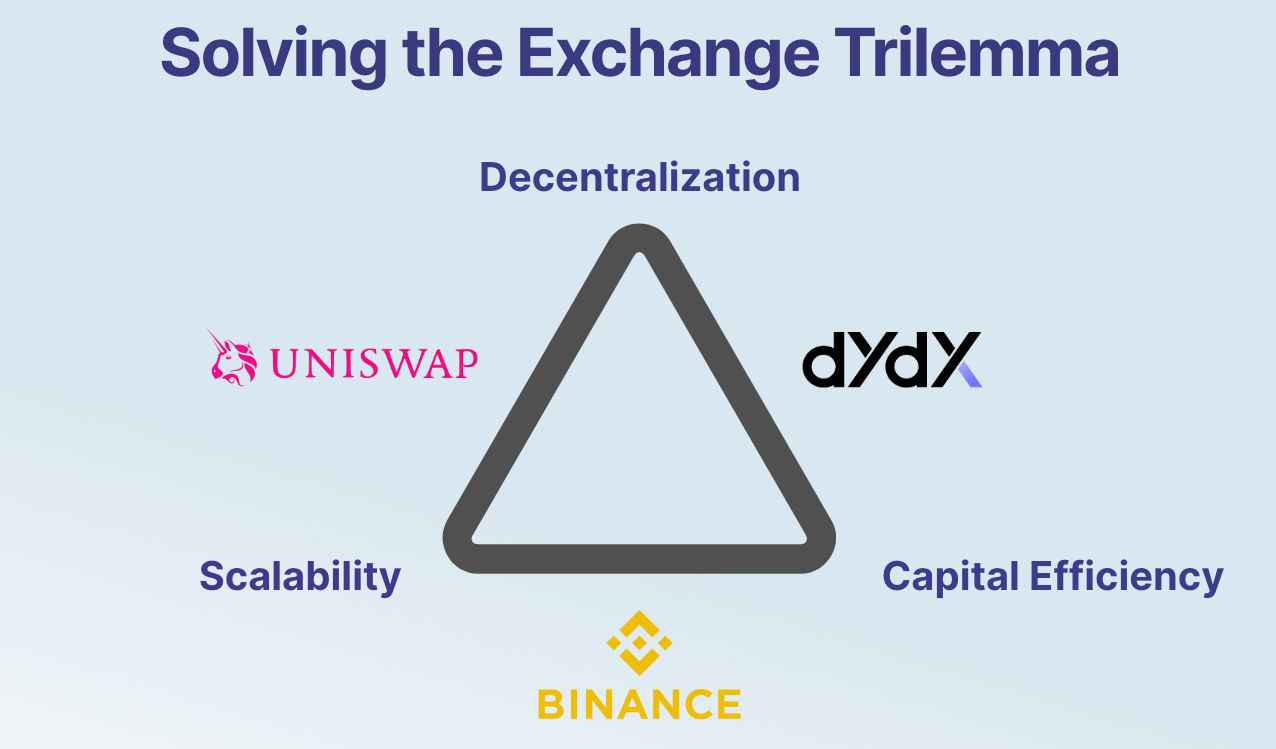

Over the past few years, it is abundantly clear that exchanging assets on-chain has reached deep product-market fit. The next natural step is scaling the applications to meet the oncoming demand. The problem is that exchanges face major scaling obstacles on existing Layer 1 and Layer 2 infrastructure. The challenge is referred to as the “Exchange Trilemma” since exchange apps cannot achieve decentralization, scalability, and capital efficiency simultaneously.

Given the unique requirements of exchange apps around speed, throughput, reliability, and frontrunning, purpose-built infrastructure is necessary to address these issues. This is where Sei comes in, providing a solution that addresses the DEX scalability problem and enables exchange apps to scale effectively while maintaining decentralization and capital efficiency.

If Sei is successful, exchanges no longer face a tradeoff to decentralization. They are able to offer the same user experience as any Web2 app while maintaining the non-negotiable benefits of decentralization: the trustless, permissionless ability to transact and prove ownership without risk of censorship.

Sei addresses the problem

Sei is an open-source, general purpose Layer 1 blockchain that was built to address the exchange scalability problem. Sei is the fastest Layer 1, purpose-built for exchange applications, optimizing every layer of the stack to offer the best infrastructure for trading apps. Sei's unique value proposition lies in its singular focus on improving the user experience for exchanges built on top. By optimizing its infrastructure for exchanges, any gaming economy, NFT marketplace, social trading app, or DeFi DEX, will operate better on Sei than on any other Layer 1.

Sei features the fastest time to finality in the industry with a lower bound of 300ms and built-in parallelization, making the infrastructure ideal for trading functionality. By leveraging two novel advancements in consensus research, Sei features Twin-Turbo consensus to reach levels of performance that no other Layer 1 has gotten. Moreover, Sei's built-in matching engine and front-running prevention provide exchanges with valuable advantages out-of-the-box. Finally, Sei's automatic order bundling capability improves app throughput and improves the user experience for all apps built on Sei.

Why build Sei as a Layer 1? Sei Labs, the development team that contributes to the Sei ecosystem, initially explored building Sei as a Layer 2 on Ethereum. There are several drawbacks of a Layer 2 rollup: 1) Decentralization. Every Layer 2 is currently using a centralized sequencer, which means there is a single entity responsible for validation and execution of user transactions. This leads to significant security, censorship resistance, and liveness concerns. 2) Throughput. The max throughput of Layer 2 is constrained by the blockspace of the underlying Layer 1 that it writes to. This results in significant scaling difficulties.

In focusing on the trading, the core use case of blockchains, Sei has created a compelling offering for developers looking to build on a general-purpose Layer 1. Trading is universally important to all applications in Web3, including gaming, social, and NFTs. By catering to this fundamental need, Sei creates a gravitational pull for users to come explore any kind of application built on Sei because trading is general purpose. There are hundreds of promising teams building on the Sei ecosystem, some moving from the largest Layer 1s and Layer 2s such as Ethereum, Solana, zkSync, Polygon and Sui.

How to get involved?

If you’re a builder, come join the hundreds of teams building in the Sei ecosystem, experimenting on new Web3 apps made possible on Sei. Apply for funding from the Sei Ecosystem Fund.

If you’re just looking to learn more, explore the apps and partners in the Sei Ecosystem or follow Sei on Twitter for the latest and greatest. You can read more about Sei’s technological innovations in the official whitepaper.