The Invisible Hand of DeFi

Introduction

By Vangelis, Sei Labs Research for Sei Research Initiative. Special thanks to Niko for feedback and contributions.

In October 2023, the Ethereum Foundation lost $9,101 in a sandwich attack while swapping 1.7 ETH via Uniswap V3. The MEV bot frontran the transaction, extracting $4,060 in profit within seconds. Contrast this with CoW Protocol’s MEV Blocker, which protected ~$40.2b volume in user funds in 2024 by routing trades through private solvers.

Solvers are specialized sophisticated actors that work behind the scenes in crypto transactions to find optimal solutions to complex problems. They take your transaction request, analyze all possible ways to execute it, and choose the best path based on users’ predefined outcomes. Some solvers aim to get you the best price across multiple exchanges, others protect your transaction from MEV, and some execute complex multi-step trades that would be nearly impossible to execute manually.

Solver Ecosystem

Across single and multi-chain environments, specialized solvers engage in a competitive process to provide optimal transaction execution costs. To win the right to execute and earn the spreads on those, these solvers adhere to predefined rules covering smart contracts, off-chain protocols, and settlement processes. Solvers compete by maximizing user surplus - whoever delivers the most value and settles on-chain first wins the auction.

At the heart of this system, a solver is tasked with discovering and executing the most optimal pricing path across networks and assets.

Broadly, solvers fall into two categories:

Algorithmic routers: These operate without holding inventory, instead indexing the available liquidity across both onchain and offchain venues to find the best execution path post - intent expression.

Inventory - managing solvers: These are usually professionals that provision their own capital across chains to directly fulfill user intents. They hedge risk via parallel exposure on external venues

Aggregators: Aggregators act as gateways for user transactions, routing orders across various DeFi protocols to find optimal execution. Solvers tap into this aggregated order flow, competing to deliver the best outcome by leveraging superior pricing models, private liquidity, and advanced execution strategies. In doing so, they not only enhance efficiency but also capture value from the flow, turning access to aggregator order flow into a key competitive edge.

Intent-based Bridges: Intent-based cross-chain bridges allow users to specify what they want to achieve, like swapping or transferring assets, without dictating the “how”. Solvers compete to fulfill these intents across chains, using their proprietary routing algos and liquidity access (private/public), to deliver the best result in a very latency sensitive manner. By optimizing execution paths and abstracting away complexity, solvers turn user intents into seamless, efficient cross-chain transactions while capturing value from fulfilling that demand

Decentralized Exchanges: Intent-based DEXs like UniswapX and CoW Protocol let users express the outcome they want - such as swapping token A for B - without specifying the exact trade path. Solvers then compete to fulfill these intents by quoting, batching orders, or leveraging MEV protection strategies. This model shifts execution logic off - chain, enabling more efficient, flexible, and user - friendly trading while solvers capture value by delivering the most optimal execution.

The Economic Impact

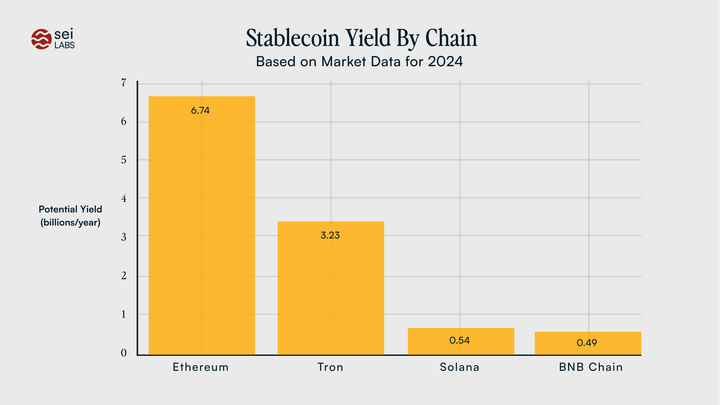

Since 2020, MEV has grown from just $80 million to over $1.1 billion in 2024. Most MEV comes from arbitrage, followed by sandwich attacks and liquidations. While Ethereum hosts most MEV activity, other chains like Solana and Binance Smart Chain are growing their shares.

This trend highlights how solver-powered infrastructure is becoming the preferred method for both efficient trading and secure cross-chain transfers. On the same chain aspect, CoW Protocol alone protected over $40.2 billion in user funds in 2024 through private solver execution - enabling intent-based trading with MEV protection.

For cross-chain activity, protocols like Across are extending the solver model to asset transfers and swaps, using intent-based mechanisms to find optimal routes and settlement paths across chains. Together, these examples show how solvers are reshaping infrastructure across the entire intent-driven stack.

Intent-based swaps grew from virtually non-existent in 2020 to capturing approximately 30% of the swap market by late 2024, directly challenging the once-dominant DEX frontends which have fallen from nearly 100% market share to just 30%. At the same time, intent-based bridging solutions have been seeing more growth, expanding from under 10% of bridge volume in early 2022 to approximately 45% by October 2024.

The Economic Equilibrium Theory

Competing solvers naturally limit MEV through basic economic principles of supply and demand. As more solvers enter the market, competition drives down the fees they can charge users while still remaining profitable. Data from Across protocol demonstrates this effect clearly. Solver fees have compressed dramatically from approximately 15 basis points in April 2023 to just 4 basis points by October 2024. This market-driven ceiling protects users from excessive extraction, as Dr. Friederike Ernst, COO at Gnosis, explains: "In a system where miners or validators have all the power to reorganize transactions, batch auctions settlements can take away that advantage" by enforcing price fairness through competitive market forces.

Users implicitly establish an "acceptable MEV" threshold, the premium they're willing to pay for convenience, security, and execution quality. Users are willing to accept some value extraction for quality execution. As transaction volume grows, this equilibrium point shifts toward lower acceptable extraction rates, effectively creating a natural market cap on solver profits.

The Evolution of Solver Technology

The next five years will see solver technology evolve through three distinct phases, each bringing blockchain interactions closer to mainstream usability. In the immediate future (1-2 years), AI integration will revolutionize solver capabilities, enabling predictive market analysis and natural language processing that translates user requests into optimized execution paths.

This will transition into a middle phase (2-5 years) where cross-chain standardization through protocols like ERC-7683 creates a unified solver ecosystem, allowing seamless operation across multiple blockchains without specialized code for each network. The long-term vision (5+ years) will deliver complete abstraction where users simply express their financial goals and constraints while sophisticated solver networks handle all technical execution invisibly across the entire digital asset landscape.

This solver revolution presents a profound centralization paradox that will shape DeFi's future power structure. While solvers democratize access by making complex operations available to everyone, economic forces may concentrate power among the most sophisticated players with advantages in capital, technology, and data processing.

The competition they introduce removes gatekeepers and forces better execution at lower fees, yet the economics of scale could lead to solver oligopolies where larger operations offer better performance but create winner-take-most dynamics. The market's ultimate direction depends on whether governance frameworks and technologies like ZKPs can maintain robust competition while preventing excessive centralization, representing both DeFi's greatest opportunity for mainstream adoption and its most significant governance challenge ahead.

Join the Sei Research Initiative

We invite developers, researchers, and community members to join us in this mission. This is an open invitation for open source collaboration to build a more scalable blockchain infrastructure. Check out Sei Protocol’s documentation, and explore Sei Foundation grant opportunities (Sei Creator Fund, Japan Ecosystem Fund). Get in touch - collaborate[at]seiresearch[dot]io

Sources:

https://cryptopotato.com/ethereum-foundation-falls-victim-to-mev-bot-attack/